Cannabis Stuff Near Me

Med & Rec Dispensaries

Marijuana Doctors

A Guide to New York's Cannabis Dispensaries

In the bustling heart of the Big Apple, a new era has started – one embraces legalized cannabis. With regulations easing and the cannabis industry thriving, New Yorkers are projecting transformation in both medical and recreational marijuana consumption.

In this guide, we’ll take a look at New York’s regulated cannabis market and the dispensaries that fuel it, whether you’re seeking relief through medical marijuana or focused on recreational marijuana the state’s dispensaries offer up a variety of cannabis options.

Understanding New York's Regulated Cannabis Landscape

Medical Marijuana: A Gateway to Relief

For those seeking therapeutic relief, New York’s medical marijuana program has evolved into a remarkably successful option. NY state is home to a multitude of dispensaries. MJ patients have access to premium, top-shelf cannabis products. Each cannabis product is tailored to successfully address various health concerns. From alleviating chronic pain to managing anxiety disorders, medical marijuana dispensaries in New York are staffed with knowledgeable professionals who work closely with patients when it comes to selecting strains and products to meet their individual needs.

Recreational Cannabis: The Dawn of a New Era

Dispensaries selling recreational cannabis hope to provide a chic experience for customers strolling. Each person will be greeted by an array of colorful strains and a menu that reads like a gourmet cannabis experience.

No doubt, the NY dispensaries are taking their lead from other successful cannabis retailers in states like Colorado, Oregon, and California. Many even want to showcase an international flair by mirroring their establishments to those found in Amsterdam. Everything is about making the decision of what bud to buy easier and more fulfilling for the customer.

Whether you’re a seasoned connoisseur or a curious newcomer to the world of recreational marijuana, the dispensaries in New York are ready with the knowledge and skills needed to meet their customers’ myriad of tastes and preferences.

When shopping for recreational marijuana, you can peruse shelves adorned with top-shelf flower, delectable edibles, potent concentrates, and innovative cannabis-infused products. Not to mention, dispensaries have hired experienced staff to answer questions and meet your needs.

A Peek Inside New York's Dispensaries

Picture this: You step into a modern dispensary, the ambiance serene and inviting. Knowledgeable budtenders stand ready to assist you promptly with any concerns or needs. You can pick from many diverse strains and products lining the shelves.

From the pungent aroma of freshly harvested cannabis to the subtle fragrance of infused lotions, each dispensary in New York offers its own unique spin on things.

The Future of Cannabis in New York

As New York’s cannabis market evolves, the synergy between medical and recreational marijuana is set to redefine the state’s relationship with this remarkable plant.

Dispensaries in the state were once solely about medical necessity but have now also embraced recreational marijuana.

New York’s Seed-to-Sale Cannabis Industry

In the heart of New York, a revolution is blooming. The once-illicit cannabis plant has emerged from the shadows, stepping into the spotlight as a legitimate and thriving industry. From cultivation to consumption, the entire journey of cannabis is known as the “seed to sale” process. All processes in the journey are strictly regulated and monitored in the Empire State.

Cultivation: Where It All Begins

Deep in the lush corners of New York, cannabis cultivation facilities are sprouting like never before. Local farmers who have called the state for generations have started to take notice of the potential for growing and harvesting the green gold.

State-of-the-art indoor farms, equipped with cutting-edge technology, nurture cannabis plants from tiny seeds to crystal-laden buds. Expert cultivators employ their knowledge of horticulture and genetics to ensure the growth of potent and flavorful cannabis strains that meet the needs of both the medical marijuana community and recreational buyers.

The cultivation process once kept clandestine like alcohol during prohibition – a dirty dark secret, is now a meticulously monitored, state-of-the-art machine that openly produces high-quality flowers that will eventually find their way onto the shelves of dispensaries across New York state and straight to consumers.

Extraction and Processing

Once the cannabis plants reach their peak through diligent cultivation arts, its time for harvest, processing, and potential extraction for use in edibles and vapes.

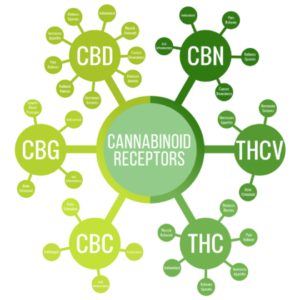

Extraction facilities, equipped with advanced machinery and skilled technicians, work their magic. Through processes like CO2 extraction and solvent-based methods, cannabinoids and terpenes are carefully extracted from the plant material. The extracted cannabinoids are used in a wide range of products, from potent concentrates to versatile oils.

Every step of the extraction and processing phase is closely monitored, ensuring the purity and quality of the final products.

Manufacturing: Cannabis Products

In the hands of skilled extraction experts, the extracted cannabinoids are transformed into a diverse array of products. Edibles, tinctures, topicals, and vape cartridges are created, and each product is accurately dosed to offer consumers a reliable and enjoyable experience.

New York’s cannabis manufacturers blend creativity with precision, introducing innovative products that cater to various preferences and needs for both the state’s medical and recreational markets.

Distribution and Retail at NY Dispensaries

The final leg of the journey involves the distribution and retail of marijuana products. At this stage of the journey, cannabis products make their way into the hands of eager consumers.

Licensed distributors ensure that products are transported securely and efficiently, adhering to stringent regulations every step of the way.

Retail dispensaries, often resembling upscale boutiques or fresh medical facilities, provide a safe and welcoming environment for enthusiasts and patients alike.

Knowledgeable budtenders work closely with customers by explaining the nuances of strains and products before a sale is made.

Consumption: A New Era of Freedom

Finally, consumers have the choice to use cannabis their way – whether for medical or recreational uses. The seed-to-sale process is an intricate part of New York’s growing cannabis marketplace.

In this dynamic landscape, New York’s cannabis industry stands has showcased itself for innovation. Clearly, NY State is committed to quality, safety, and consumer satisfaction.

As the industry continues to flourish, New York’s cannabis enthusiasts can look forward to a future brimming with possibilities.

Who Can Open an NY Cannabis Dispensary?

Once there was a cap on NY cannabis dispensaries and people who had hopes of owning one of the businesses felt like they had to jump through a million hoops to even be considered for a license. However, as with all things, change comes.

Individuals aspiring to engage in legal cannabis cultivation, processing, or sales in New York can now apply for a state license. The Cannabis Control Board voted to expand the state’s recreational marijuana program to the general public. Under the auspices of the state Office of Cannabis Management, the board approves applications for cultivators, processors, microbusinesses, and retailers to commence operations.

Unlike the initial licenses awarded through the Conditional Adult-Use Retail Dispensary program (CAURD), applicants are not required to have a previous marijuana conviction. The state’s CAURD program was initially granted preferential application rights to individuals with previous justice involvement, provided they could demonstrate two years of business operations and experience. However, this preference was challenged in court and eventually deemed unconstitutional.

The Style of New York Dispensaries

The dispensaries of New York do not resemble a so-called ‘head shop’ or ‘smoke store’. They are now upscale and professional establishments where customers can feel comfortable making informed decisions and purchases.

New York’s cannabis dispensaries, seamlessly blend sophistication with expertise. Most of the dispensaries blend modern aesthetics and cannabis by featuring sleep interiors, minimalist designs, and a welcoming ambiance. You’ll notice that they have everything from polished wood to chic lighting. It’s all about style and comfort for customers.

The dispensaries are staffed with knowledgeable and professional budtenders who have been trained to assist both beginners and experienced consumers. The budtender’s expertise extends beyond product knowledge; they offer insights into strains, consumption methods, and even wellness tips.

New York dispensaries pride themselves on offering a diverse selection of products. From premium cannabis strains to artisanal edibles and top-tier concentrates, every product undergoes rigorous quality checks. You can expect a diverse array of options, ensuring there’s something for every taste and preference.

It’s all about innovation at New York dispensaries where they integrate cutting-edge technology into the shopping experience. Most of the NY dispensaries feature interactive digital menus, online ordering platforms, and virtual consultations to truly enhance customer convenience. These tech-driven solutions reflect NY state’s forward-thinking approach to cannabis retail.

Education is important in New York dispensaries. Engaging informational materials, workshops, and in-store events provide customers with a deeper understanding of cannabis. Most dispensaries actively promote responsible consumption, guiding customers in making informed choices.

Cannabis Dispensaries and the Community

New York dispensaries foster a sense of community by actively engaging with local initiatives. Collaborations with artists, social causes, and community events are common throughout NYC and other areas of the state. The collaborations with the community foster a welcoming atmosphere.

Dispensaries often host educational seminars and support social equity programs, contributing positively to the neighborhoods they serve.

As New York’s cannabis industry continues to evolve, dispensaries will also undergo changes – but as most New Yorkers and visitors hope, those changes will be for the positive and will ultimately set examples that other dispensaries in the nation can follow.